National Company Law Tribunal (NCLT): Detailed Jurisdiction Overview

Dated

0

Comments

National Company Law Tribunal (NCLT): Detailed Jurisdiction Overview

The National Company Law Tribunal (NCLT) is a specialized quasi-judicial body established under Section 408 of the Companies Act, 2013, operating since June 1, 2016. It serves as the primary adjudicating authority for company law disputes and insolvency matters in India, having replaced the Company Law Board.

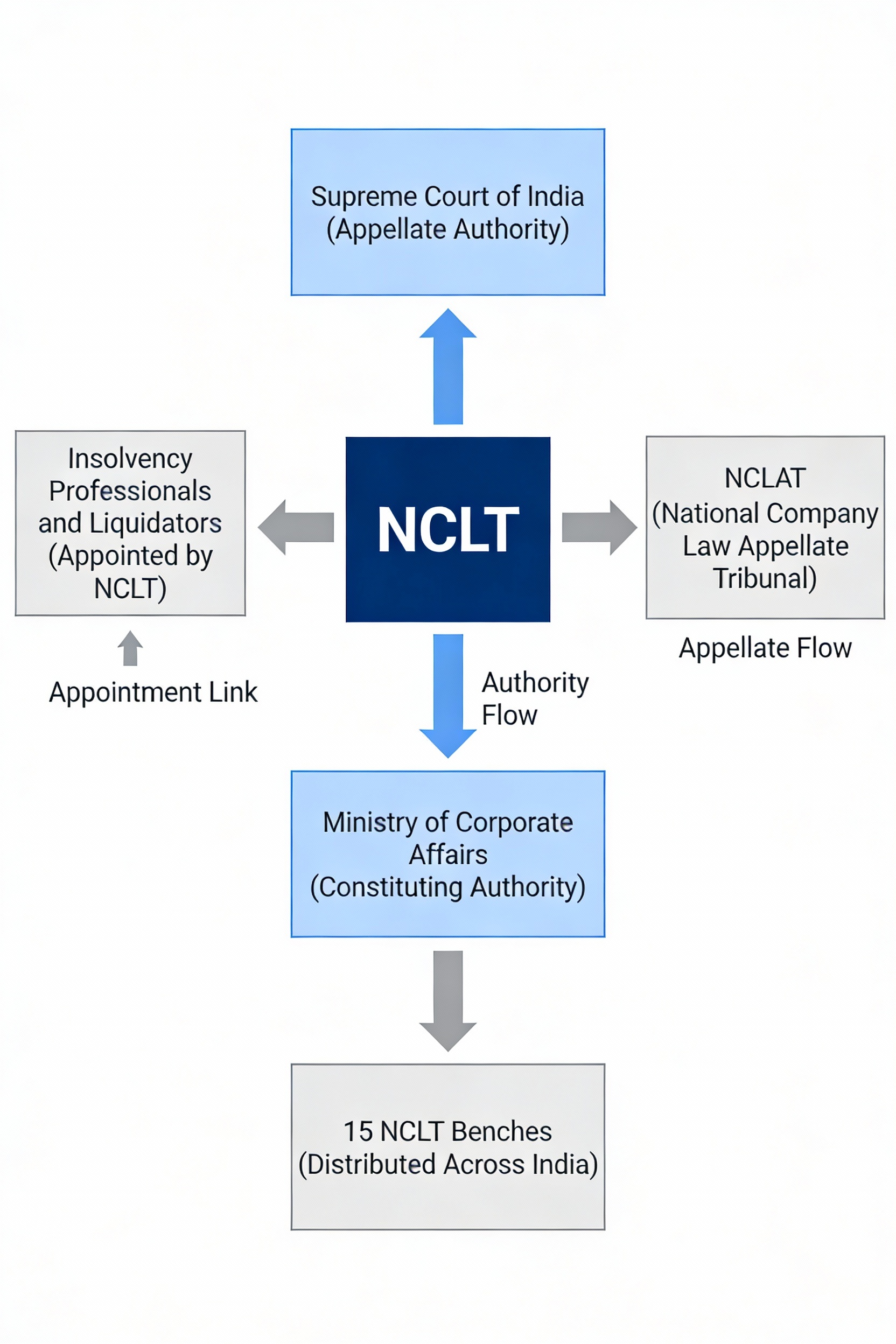

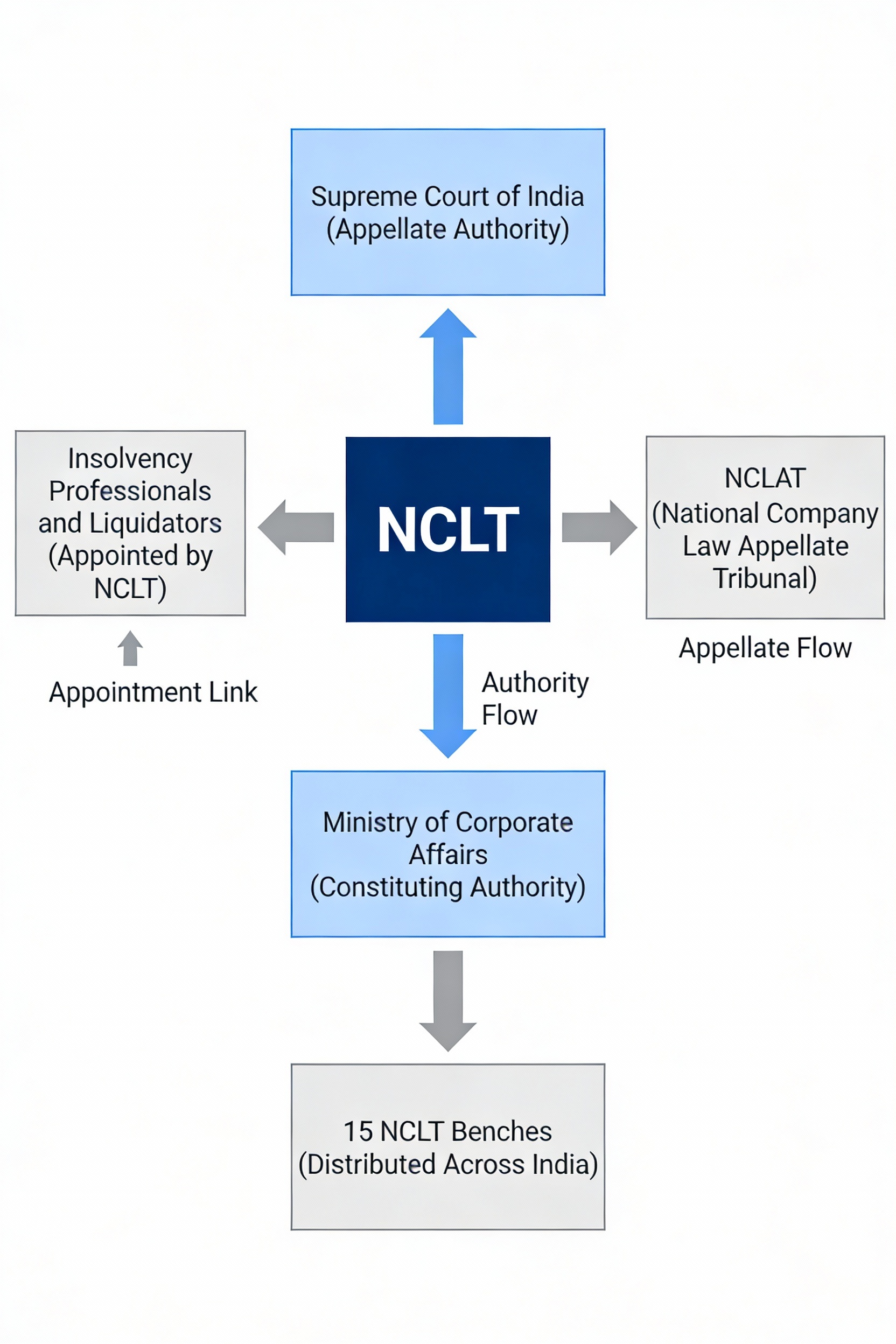

Hierarchical Structure of NCLT Jurisdiction

Territorial and Geographical Jurisdiction

The NCLT operates through a decentralized system with 15 benches strategically located across India to ensure equitable access to justice. The tribunal comprises a Principal Bench at New Delhi and 14 additional benches distributed across major cities.

NCLT Benches and Territorial Jurisdictions Across India

Jurisdiction Determination

The appropriate bench is determined by the registered office location of the company. When filing petitions or applications, cases must be submitted to the bench having territorial jurisdiction over the state or union territory where the company's registered office is situated.

Subject Matter Jurisdiction

NCLT possesses extensive jurisdiction covering both company law matters under the Companies Act, 2013 and insolvency matters under the Insolvency and Bankruptcy Code, 2016.

Company Law Matters

Oppression and Mismanagement (Sections 241-242): Members can file applications when company affairs are conducted in a manner oppressive to shareholders or involving gross mismanagement. Under Section 242, the NCLT can regulate company affairs, remove directors, restrict share transfers, order buyouts at fair value, modify articles of association, or direct company winding up in extreme cases.

Winding Up of Companies (Sections 271-307): NCLT has exclusive jurisdiction to order liquidation when companies cannot pay debts, engage in fraudulent activities, act against India's sovereignty, or persistently fail to comply with statutory obligations.

Mergers and Demergers (Sections 230-234): NCLT must sanction all schemes of arrangement, merger, and demerger. The tribunal ensures schemes are bona fide and protective of stakeholder interests. Fast-track mergers between small companies or holding-subsidiary arrangements can proceed without NCLT approval under Section 233.

Share Transfers and Securities (Sections 58-59): NCLT addresses refusals to register share transfers by companies and handles transmission matters. Transferees have 60-90 days to appeal against refusal, and the tribunal can order share registration or rectification of member registers.

Deposits and Class Actions (Chapter V and Section 245): NCLT handles matters related to company deposits and class action suits by members or creditors when company affairs are conducted prejudicially.

Rectification of Company Registers (Section 52): The tribunal corrects defects in registers of members, rectifies share certificate errors, removes fraudulent entries, and restores improperly deleted names.

Restriction on Incurring Liabilities (Section 327): Debenture trustees can seek restrictions when company assets are insufficient to prevent further liability incurrence.

Reopening of Accounts (Section 267): NCLT can order reopening of company accounts when fraudulent practices or gross mismanagement are suspected.

Comprehensive Categories of Matters Under NCLT Jurisdiction

Insolvency and Bankruptcy Matters

Under the Insolvency and Bankruptcy Code, 2016, NCLT acts as the Adjudicating Authority for corporate insolvency resolution and liquidation.

Corporate Insolvency Resolution Process (CIRP): Financial creditors can initiate applications when default occurs, operational creditors after notice periods, and corporate debtors voluntarily. The NCLT verifies default existence within 14 days, appoints Insolvency Resolution Professionals, oversees creditor committees, examines resolution plans, and grants time extensions.

Liquidation Proceedings: When resolution plans fail, maximum time periods expire, or creditors vote for liquidation, NCLT appoints liquidators, oversees asset realization, approves creditor distributions, and orders company asset sales.

Fraudulent and Wrongful Trading (Section 66 IBC): NCLT can order liability on those knowingly party to fraudulent business operations, requiring contributions to company assets and addressing wrongful trading by directors.

Undervalued and Extortionate Transactions (Sections 50-51 IBC): The tribunal can set aside undervalued transactions, restore previous positions, impose liabilities, recover considerations, and modify exorbitant credit terms.

The NCLT operates under the Ministry of Corporate Affairs, with appeals directed to the National Company Law Appellate Tribunal (NCLAT) and further appeals to the Supreme Court. The tribunal coordinates with Registrars of Companies, SEBI, Insolvency Professionals, and Liquidators appointed in various proceedings.

Key Jurisdictional Characteristics

Exclusive Jurisdiction: Section 430 of the Companies Act bars civil court jurisdiction over matters the NCLT/NCLAT is empowered to determine. This ensures specialized and efficient resolution without conflicting parallel proceedings.

Quasi-Judicial Nature: Combining court and administrative elements, NCLT applies company law and insolvency provisions, follows modified civil procedure, and issues binding orders equivalent to civil court judgments.

Specialized Expertise: With judicial members drawn from senior retired judges and technical members with accounting, taxation, and corporate management expertise, the tribunal provides specialized dispute resolution.

Unique Powers: NCLT possesses injunctive authority to restrain oppressive conduct, can restructure companies through mergers and demergers, manages corporate insolvency resolution and liquidation, orders remedies like buyouts and compensation, and can impose penalties and sanctions.

Comprehensive Documentation

This resource provides a complete guide to NCLT jurisdiction with detailed coverage of all matters, statutory sections, procedures, and organizational relationships essential for corporate professionals, legal practitioners, and business stakeholders involved in company law disputes, mergers and acquisitions, insolvency proceedings, or shareholder matters.

Organizational Structure and Relationships

Hierarchical relationship between NCLT and related institutions.

The NCLT operates under the Ministry of Corporate Affairs, with appeals directed to the National Company Law Appellate Tribunal (NCLAT) and further appeals to the Supreme Court. The tribunal coordinates with Registrars of Companies, SEBI, Insolvency Professionals, and Liquidators appointed in various proceedings.

Key Jurisdictional Characteristics

Exclusive Jurisdiction: Section 430 of the Companies Act bars civil court jurisdiction over matters the NCLT/NCLAT is empowered to determine. This ensures specialized and efficient resolution without conflicting parallel proceedings.

Quasi-Judicial Nature: Combining court and administrative elements, NCLT applies company law and insolvency provisions, follows modified civil procedure, and issues binding orders equivalent to civil court judgments.

Specialized Expertise: With judicial members drawn from senior retired judges and technical members with accounting, taxation, and corporate management expertise, the tribunal provides specialized dispute resolution.

Unique Powers: NCLT possesses injunctive authority to restrain oppressive conduct, can restructure companies through mergers and demergers, manages corporate insolvency resolution and liquidation, orders remedies like buyouts and compensation, and can impose penalties and sanctions.

Comprehensive Documentation

This resource provides a complete guide to NCLT jurisdiction with detailed coverage of all matters, statutory sections, procedures, and organizational relationships essential for corporate professionals, legal practitioners, and business stakeholders involved in company law disputes, mergers and acquisitions, insolvency proceedings, or shareholder matters.

Post a Comment