International Trade Law: India's Strategic Role in Global Commerce

Dated

0

Comments

International Trade Law: Practice Areas and India's Strategic Role in Global Commerce

International trade law represents one of the most dynamic and complex areas of legal practice, governing the movement of goods and services across borders while balancing national interests with multilateral commitments. For Indian legal professionals, understanding the breadth of international trade law practice areas is essential—particularly as India emerges as a significant player in the WTO dispute settlement system, expands its bilateral free trade agreement network, and develops robust export controls and customs administration frameworks.

Understanding International Trade Law: Scope and Strategic Importance

International trade law encompasses the legal rules and institutions governing cross-border commerce at multiple regulatory levels: the multilateral system (World Trade Organization), regional trade arrangements (Free Trade Agreements), bilateral agreements between nations, and unilateral domestic measures implemented through national legislation. Unlike purely domestic commercial law, international trade law must navigate the intersection of national sovereignty, binding treaty obligations, and increasingly, considerations of sustainability and digital commerce.

The contemporary landscape of international trade is being fundamentally reshaped by three critical trends. First, environmental sustainability and climate-conscious practices are being increasingly integrated into trade policies through mechanisms such as carbon border adjustments and green tariffs, reflecting global recognition that trade cannot remain divorced from environmental responsibility. Second, the digital economy and e-commerce are transforming international commerce, necessitating new regulatory approaches for cross-border data flows and digital product distribution—areas where national security concerns frequently conflict with trade efficiency. Third, governments are continuously revising trade-related national laws and regulations, creating what practitioners describe as "a thicket of rules, procedures, and exceptions" that make the business environment simultaneously more challenging and more opportunity-rich for legal professionals who master this domain.

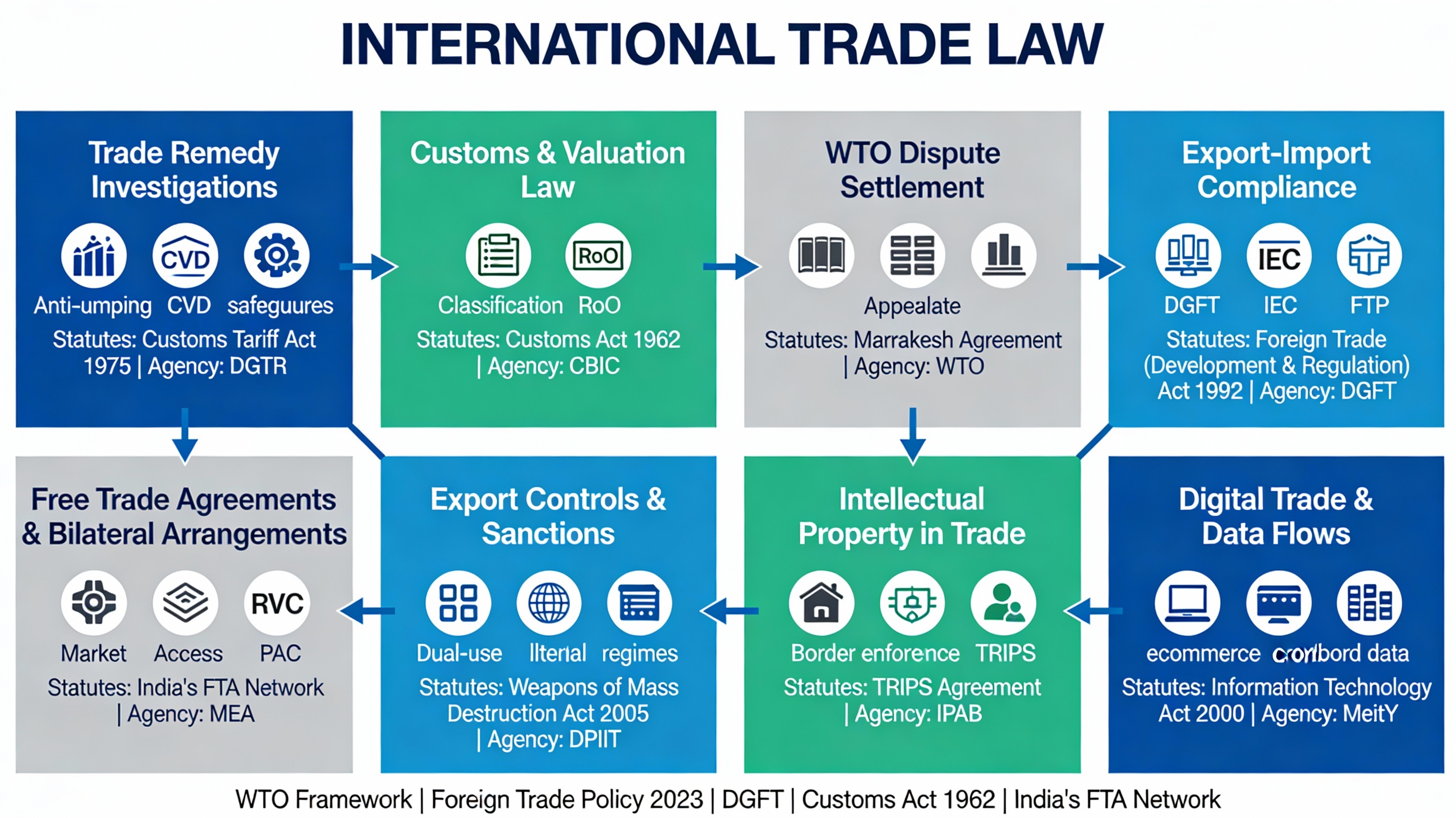

International Trade Law Areas - Comprehensive Framework Infographic

Core Practice Areas in International Trade Law

1. Trade Remedy Investigations: Protecting Domestic Industry from Unfair Trade

Trade remedy practice represents one of the highest-value specializations within international trade law. This area addresses three critical mechanisms through which governments protect domestic industries from unfair import practices: anti-dumping duties, countervailing duties, and safeguard measures.

Anti-Dumping Investigations (ADD)

Anti-dumping duties are protectionist tariffs imposed by governments on foreign imports determined to be priced below fair market value in the exporting country. In India, anti-dumping investigations are conducted by the Directorate General of Trade Remedies (DGTR), operating under the Ministry of Commerce and Industry, which performs quasi-judicial functions including determination of dumping margins, assessment of injury to domestic industry, and establishment of causal nexus between dumped imports and injury. The DGTR's recommendations are then forwarded to the Ministry of Finance, which retains discretion to impose, modify, or reject recommended duties through official notification.

The statutory framework draws extensively from the WTO Anti-Dumping Agreement, ensuring India's measures remain compliant with international obligations while providing procedural certainty for domestic industry petitioners. India maintains its position as one of the world's largest users of anti-dumping duties, with the majority of investigations targeting imports from China, reflecting both the scale of trade flows from that jurisdiction and competitive pressures in labor-intensive sectors.

Practitioners in this field must develop expertise in comparative pricing analysis, domestic like-product determinations, injury assessments under sophisticated econometric models, and advocacy before quasi-judicial tribunals with technical expertise in international trade economics.

Countervailing Duty Investigations (CVD/Anti-Subsidy)

Countervailing duty, also known as anti-subsidy duty, is imposed to counteract subsidization by foreign governments that result in cheaper unfair imports causing injury to Indian producers. The practice is governed by the WTO Agreement on Subsidies and Countervailing Measures (SCM Agreement), which defines permissible and prohibited subsidies and establishes investigation procedures.

Unlike anti-dumping duties, which focus on pricing, countervailing duty investigations examine government support mechanisms—whether explicit or disguised. Modern investigations increasingly confront sophisticated forms of indirect subsidization, including state-supported enterprises, opaque loan programs, and indirect subsidies requiring deeper forensic investigation. India's sugar and fisheries sectors have been subject to multiple CVD investigations initiated by WTO members alleging unlawful subsidization, requiring sophisticated defense strategies.

Safeguard Measures

Safeguard measures represent temporary protection mechanisms available under WTO rules when imports surge unexpectedly, threatening domestic industry. Unlike anti-dumping and countervailing duties (which target unfair practices), safeguard duties apply to fair-priced imports when their volume creates injury. The WTO Safeguards Agreement strictly limits duration (typically 4 years with potential 10-year extension) and requires transition adjustment assistance to facilitate industry adaptation.

2. Customs and Valuation Law: The Technical Foundation of Trade Compliance

Customs law and valuation practice form the technical backbone of international trade regulation, addressing how goods are classified, valued, and assessed for duties and compliance purposes.

Customs Valuation

The Customs Valuation Rules establish a hierarchical methodology for determining the duty-paid value of imported goods, directly affecting the amount of customs duties, anti-dumping duties, and countervailing duties imposed. The valuation hierarchy proceeds sequentially: (i) transaction value of goods sold for export to India; (ii) transaction value of identical goods; (iii) transaction value of similar goods; (iv) deductive value based on domestic resale; (v) computed value based on cost of production plus mark-up; and (vi) fallback determination using reasonable means consistent with WTO principles.

A critical practical issue in customs valuation involves determining whether sales between related parties (parent and subsidiary, for instance) reflect arm's-length pricing. The regulations provide that transaction values are accepted if the importer demonstrates the declared value closely approximates independent market transactions for identical or similar goods.

Rules of Origin (RoO) and Product Classification

Rules of Origin determine the national source of a product, ensuring that only goods genuinely originating from partner countries benefit from preferential tariff rates under Free Trade Agreements. This practice area has become increasingly sophisticated as India negotiates modern trade agreements featuring flexible, trader-friendly origin frameworks.

India's recent trade negotiations reflect evolution from rigid, single-proof origin systems toward multifaceted verification approaches. The India-EFTA Trade and Economic Partnership Agreement (TEPA), currently under negotiation, exemplifies this evolution through four co-existing proof-of-origin pathways: EFTA Origin Declaration by Approved Exporters (self-certification), EFTA EUR.1 Movement Certificates (formal certification), India Agency-Issued Certificates of Origin (government-issued), and Self-Declared Certificates by Indian Exporters (expedited self-certification). This multiplicity accommodates different exporter profiles—from large corporations to small enterprises—reducing dependency on single systems and minimizing documentation burdens aligned with Revised Kyoto Convention (RKC) principles.

Diagonal cumulation represents another innovation, allowing inputs from any EFTA state or India to count toward originating status regardless of where the last substantial transformation occurs, facilitating regional value chains and supply chain integration. The India-UK Free Trade Agreement reflects comparable sophistication, requiring goods to meet minimum 40-45% Regional Value Content (RVC) thresholds and often demonstrating substantial transformation through change in tariff subheading (CTSH).

Classification and Tariff Code Determination

India recently updated its export classification system (January 2025), implementing the globally-standardized 8-digit ITC-HS (Indian Trade Classification - Harmonized System) code, replacing description-based systems with precise code-based classification. The classification determines whether goods fall under "free" (no license required), "restricted" (license required), "prohibited," or "State Trading Enterprise only" categories.

3. WTO Dispute Settlement: Representing Interests Before the Multilateral System

The WTO Dispute Settlement Understanding (DSU) provides the primary mechanism through which member states resolve trade disputes arising from alleged violations of covered agreements (GATT, GATS, TRIPS, SCM, Anti-Dumping, Safeguards, etc.).

The Dispute Settlement Process

The process unfolds through distinct stages. Consultation (30 days) requires direct negotiation between disputing members; if unsuccessful, the complaining member requests establishment of a panel—typically a three-member adjudicative body that examines evidence and issues factual and legal findings. Historically, either party could appeal panel reports to the Appellate Body for legal review, but the Appellate Body has been non-functional since late 2016 due to procedural disputes, creating significant uncertainty in dispute outcomes.

If a dispute is decided in favor of the complaining member, the defending member must comply within typically 15 months (or 30 months for developing countries under special arrangements proposed by India). Non-compliance triggers authorization of the Dispute Settlement Body for the complaining member to suspend concessions or impose countermeasures.

India's Active Participation and Strategic Positions

As a founding GATT/WTO member, India has been actively involved in the dispute settlement system, with particular concentration in trade remedies, textile and clothing measures, and market access disputes. India has advanced progressive positions advocating for special and differential (S&D) treatment of developing countries, proposing extended implementation timelines for developing country respondents and authorizing joint retaliation by all WTO members against developed country violations affecting developing country interests.

India has pursued high-profile disputes as both complainant and respondent. As a complainant, India successfully challenged the United States' domestic content requirements and state-level subsidies for the renewable energy sector, with a panel ruling that 10 US measures were incompatible with GATT 1994 obligations. Conversely, as a respondent, India has faced challenges to its sugar subsidies (initiated by Guatemala, Brazil, and Australia), fisheries subsidies, solar panel subsidies, and IT/telecom import tariffs (challenged by Japan, EU, and the United States). Most notably, in February 2024 at WTO's 13th Ministerial Conference, India called for restoration of the Appellate Body as the top-most priority of any dispute settlement reform, emphasizing that a "credible and reliable WTO DS system is the bedrock of an equitable, effective, secure and predictable multilateral trading system."

4. Export-Import Compliance and Foreign Trade Policy Administration

The Foreign Trade Policy (FTP) 2023, administered by the Directorate General of Foreign Trade (DGFT) under the Foreign Trade (Development and Regulation) Act, 1992, forms the primary regulatory framework governing India's international merchandise trade. Understanding FTP compliance represents an essential competency for practitioners advising exporters and importers.

Import-Export Code and Basic Compliance

All entities engaged in trade must obtain an electronic Import-Export Code (IEC), a 10-digit identifier issued by DGFT, which is mandatorily required for customs clearance, shipment dispatch, and foreign currency transactions. Once obtained, importers and exporters must ensure compliance with multiple regulatory layers: the Customs Act, 1962, the Foreign Trade Policy, 2023, and item-specific rules outlined in the ITC (HS) Schedule I (for imports) and Schedule II (for exports).

Export Classification and Licensing

India's January 2025 update to the export classification system represents a significant modernization, standardizing all merchandise goods using the 8-digit ITC-HS code and categorizing goods into four classifications: Free (no license), Restricted (license required), Prohibited (not eligible), and State Trading Enterprises (STE) only. This systematization enhances transparency and reduces ambiguity in compliance determination.

Export Promotion Schemes

The Foreign Trade Policy includes multiple schemes designed to enhance export competitiveness. The Advance Authorisation Scheme (launched 2023) enables duty-free import of inputs for export-oriented production, with eligibility determined by Sector-specific Norms Committees based on input-output norms. The Export Promotion Capital Goods (EPCG) Scheme provides similar duty-free import benefits for capital equipment essential for export production. Non-Preferential Certificates of Origin, issued by entities including the Indian Chamber of Commerce, certify that exported goods originate in India, supporting market access claims.

5. Free Trade Agreements and Bilateral Trade Arrangements

India maintains an expanding network of bilateral and regional trade agreements, each negotiated to maximize market access for Indian exporters while protecting sensitive domestic sectors. Understanding the unique features and comparative advantages of India's FTA network is essential for practitioners advising multinational enterprises and exporters.

India's Active FTA Portfolio

India has concluded FTAs with ASEAN, Japan, Korea, UAE, Mauritius, and other trading partners, with ongoing negotiations including the UK (recently signed), EFTA, Israel (Terms of Reference signed November 2025), and continued discussions with the United States. Each agreement is strategically negotiated to reflect India's sectoral priorities and relative bargaining position.

Market Access and Preferential Tariff Negotiations

FTA negotiations address tariff schedules determining which goods receive preferential duty rates, rules of origin defining product origination criteria, and service sector commitments establishing market access for service providers. The India-UAE CEPA and India-UK FTA exemplify India's focus on maximizing concessions in pharmaceuticals, IT services, textiles, agricultural products, and manufactured goods while maintaining protective tariffs for sensitive sectors.

Services Liberalization and Investment Provisions

Modern FTAs incorporate significant services commitments under the GATS (General Agreement on Trade in Services) framework, addressing professional services, IT services, telecommunications, and financial services. India has historically emphasized IT services market access, reflecting competitive advantage in this sector. Concurrently, FTAs increasingly include investment provisions, intellectual property chapters addressing TRIPS-plus standards, and technical barriers to trade (TBT) and sanitary & phytosanitary (SPS) provisions facilitating non-tariff market access.

6. Export Controls, Sanctions, and Dual-Use Item Regulation

Export controls and sanctions practice represents an increasingly critical specialization as governments employ trade restrictions to pursue national security and foreign policy objectives.

India's Export Control Framework

India maintains a harmonized export control framework for dual-use items and military goods administered through the DGFT under the Foreign Trade (Development & Regulation) Act, 1992, complemented by the Weapons of Mass Destruction and their Delivery Systems Act. Dual-use items—goods with both civilian and military applications including software and technologies—require export licenses before dispatch, with DGFT assessments conducted in consultation with Inter-Ministerial Working Groups to ensure exports align with national security and international non-proliferation commitments.

Multilateral Export Control Regimes

India participates in key multilateral export control regimes including the Missile Technology Control Regime and the Wassenaar Arrangement, harmonizing domestic controls with international standards for sensitive technologies.

UN and Autonomous Sanctions Compliance

India enforces both mandatory UN Security Council sanctions and autonomous sanctions reflecting national interests. While India has never imposed formal unilateral sanctions like arms embargoes, it has implemented autonomous restrictions in pursuit of national security—including investment restrictions on Chinese entities following border tensions and withdrawal of Pakistan's Most-Favored-Nation (MFN) status following the Pulwama attack. Regulations specifically address money laundering and terrorist financing concerns, with compliance monitored by the Central Board of Indirect Taxes and Customs (CBIC).

Secondary Sanctions Exposure

An increasingly important consideration is exposure to secondary sanctions, particularly US sanctions imposed by the Office of Foreign Assets Control (OFAC) on third parties engaging with US-sanctioned entities. Indian entities must monitor OFAC's Specifically Designated Nationals (SDN) list and implement compliance programs to mitigate secondary sanctions risk.

7. Intellectual Property in International Trade: Border Enforcement and TRIPS

While intellectual property law traditionally falls within a separate practice domain, international trade law practitioners must understand IP enforcement mechanisms at borders and IP provisions in trade agreements.

Border IPR Enforcement

Customs authorities possess authority to seize and destroy counterfeit and pirated goods at borders, protecting IP holders from infringing imports. Detailed investigations are conducted to determine infringement; upon confirmation, goods are confiscated and destroyed or disposed of outside normal commerce channels, with applicable penalties imposed on importers. This practice requires coordination between customs administration, IP holders, and adjudicating authorities.

IP Provisions in Trade Agreements

Modern FTAs include intellectual property chapters establishing TRIPS-plus standards—higher protections than WTO minimum standards—addressing patent protection periods, trademark enforcement, copyright terms, and trade secret protection. Negotiation of these provisions involves balancing developed country IP holder interests against developing country concerns regarding access to medicines and technologies.

8. Digital Trade and Cross-Border Data Flows: The Emerging Frontier

Digital trade and cross-border data flows represent the most rapidly evolving practice area, at the intersection of trade law, data protection, cybersecurity, and emerging technologies.Regulatory Complexity and Competing Interests

Governments increasingly adopt data localization requirements mandating that certain data be stored within national borders, pursuing legitimate objectives including data security, national sovereignty, and local control over citizen information. However, data localization impedes efficiency of cross-border data flows and increases compliance costs for multinational enterprises. This tension has created a complex patchwork of national regulations where businesses operating across multiple jurisdictions face conflicting legal requirements.

International Standards and FTA Provisions

The World Customs Organization (WCO) has developed an e-commerce framework promoting harmonized approaches to risk assessment, advance electronic data exchange, and border cooperation for cross-border e-commerce. Modern FTAs increasingly include data flow clauses—exemplified in USMCA and CPTPP—recognizing that "each party may have its own regulatory requirements concerning transfer of information by electronic means" while simultaneously obligating parties to "allow the cross-border transfer of information by electronic means, including personal information."

Artificial Intelligence and Technology Tensions

As governments address rapid development in artificial intelligence, cloud storage, blockchain, and self-driving vehicles, tensions escalate between national security interests and tech protectionism. Export controls are increasingly applied to emerging technologies, and governments set standards for data movement driven by national security and citizen privacy concerns as much as economic interests.

Practical Considerations in International Trade Law Practice

Regulatory Coordination Across Multiple Agencies

International trade disputes and transactions invariably involve coordination across multiple agencies. Export-import compliance requires engagement with DGFT, Customs authorities (CBIC), Reserve Bank of India (foreign currency), and sectoral regulators (pharmaceutical boards, agriculture ministries). Trade remedy defense necessitates coordination between government counsel, affected domestic industry, and foreign exporters potentially subject to investigations.

Documentary and Evidence Management

Trade disputes are won and lost on the quality of documentary evidence. Custom valuation disputes require detailed cost accounting, production records, and comparable pricing analyses. Trade remedy investigations demand comprehensive data on dumping margins, subsidization levels, pricing histories, and injury indicators. Practitioners must develop sophisticated document management and forensic analysis capabilities.

Temporal Urgency and Strategic Planning

Unlike traditional litigation, trade disputes operate under strict timelines imposed by statute and WTO rules. WTO consultations must commence within specified periods. Trade remedy investigations have fixed durations (typically 9-15 months). FTA negotiations have political windows. Strategic planning must consider these temporal constraints when advising clients.

Conclusion: International Trade Law as Strategic Business Practice

International trade law has evolved from technical tariff and customs regulation into a comprehensive practice domain addressing geopolitical strategy, technological innovation, sustainability, and fundamental questions about national sovereignty versus multilateral commitments. The legal landscape is characterized by increasing regulatory sophistication, heightened stakes in trade disputes, and rapid evolution in digital trade and emerging technologies.

For Indian legal professionals, the opportunities are substantial. India's central role in WTO dispute settlement, its expanding FTA network, and its emergence as both an export powerhouse and significant import market position practitioners who master international trade law to advise multinational enterprises, government agencies, and Indian businesses navigating this complex terrain.

Building expertise requires sustained investment in understanding the intricate interplay between WTO law, India's FTP framework, the technical requirements of customs administration, the economics of trade remedies, and the strategic considerations underlying bilateral trade negotiations. Practitioners who develop this comprehensive mastery will find themselves in high demand—advising clients on disputes worth hundreds of millions of dollars, structuring transactions to optimize tariff treatment, and helping India assert its interests in the multilateral trading system.

Tags :

International Trade Law

Post a Comment